I was perplexed as a child when I noticed people’s religious behaviours. Everyone around me seemed to believe in a god. They went to temples; they took part in elaborate prayers and rituals. At the same time, they also acted as if god won’t help them. They all acted as if they were on their own. I never understood why.

|

| Photo credit: wallpaperflare.com |

Fast forward to today. I know 3 people who are proponents of index investing. All 3 of them recommend against active investing such as investing in active mutual funds. However, every one of them is against investing in any NSE index other than Nifty 50!

A basic idea of passive investing is reducing the number of active choices we make. Our active choices don’t always work in our favour, so passive investors voluntarily give up control and let the market decide what they hold. In that view, investing in Nifty 50 is a more active choice than investing in a broader index like Nifty 500. (What do I mean by “active choice”? See Not all index investing is passive investing.) I believe that passive investors should prefer broader indices like Nifty 500.

But no. Contrary to my understanding, no one recommends going beyond the top 50. Take Pattu of freefincal.com for example. He is not enthusiastic about investing in the top 50 companies of the US market. But when it comes to the Indian market, he recommends just the opposite: “avoid going beyond the top 50” is his advice.

|

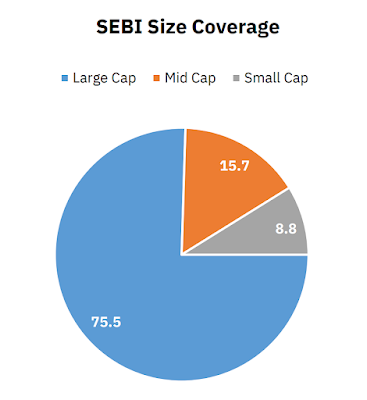

| Nifty 50 investors lack exposure to more than 25% of the Indian market cap (image source) |

Going back to my confusion about other people’s relationship with god: I eventually learnt to ignore other people’s beliefs and behaviours. These days I only care about my own relationship with god. I am comfortable holding opinions that are not commonly held or doing things that are not commonly done.

I am not as comfortable with investing. Not yet.

I want to invest in Nifty 500, but everyone says “beyond Nifty 50, there be dragons!” I think my hesitation is not about losing money. The 3 people whom I mentioned earlier — I respect these people. I trust their judgement. None of them is enthusiastic about anything beyond Nifty 50. Ignoring their advice and investing in Nifty 500 is a big leap. Big leaps are often scary. Maybe this is a rite of passage that I have to go through to become the independent investor that I want to be.

Update (6-Aug-2023): I wrote a follow-up blog post comparing Nifty 50 and Nifty 500.

No comments:

Post a Comment