A popular investment advice is to “invest in a low-cost mutual fund that tracks a diversified index”. There are two parts to this advice.

- Why index fund? The arithmetic of index investing explains why it makes sense to passively invest in an index rather than trying to take active positions to beat the index.

- Why low cost? From the point above, we accept that market return is the best we can do. Since mutual funds cost money to run, the lower the cost the higher the return investors can enjoy.

If I want to invest in the Indian share market, what are my options? There isn’t a mutual fund that tracks the entire Indian market. The most popular index is Nifty 50, while broadest investable index is Nifty 500. I am going to compare these 2 with the goal of finding out what we get from each index and what the tradeoffs are.

Diversification

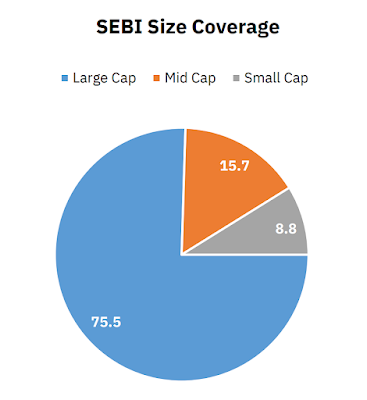

Nifty 50 captures 66% of the Indian market cap, and only contains large cap companies. Nifty 500 captures more than 90% of the Indian market cap, and has large, mid, and small cap companies.

In general, the larger the index the more diversified it is. Any index that does not represent 100% of the market is taking an active position. (See Not all index investing is passive investing.) Nifty 500 is more passive and more diversified than Nifty 50.

Liquidity

While large cap Indian companies see high trading volumes, mid and small cap Indian companies are not traded as frequently. However, according to the NSE index construction methodology, every constituent of both indices must have traded on at least 90% of the days in the assessment period (past 6 months). In other words, both Nifty 50 and Nifty 500 have the same liquidity criteria.

There is no systemic advantage to Nifty 50 here, but in practice, large cap Nifty 50 companies see much greater trading volume than small cap companies. In comparison to Nifty 50, yes, Nifty 500 is at a disadvantage.

Impact cost

Impact cost is inversely proportional to trading volume. Low trading volume, or low liquidity, means that the impact cost is high.

Nifty 50 companies by definition have less impact cost than Nifty 500. According to the index methodologies used, a stock should have an impact cost of 0.5% or less to be included in the Nifty 50 index. Nifty 500 allows impact costs of up to 1%. So in reality and on paper, Nifty 500 has a higher impact cost.

Portfolio churn

Portfolio churn happens in index funds when new companies move into the index to replace an incumbent. When the index constituents change, index funds sell the companies that left the index and buy the ones that entered the index.

It doesn’t always need to happen this way, but the index changes often happen near the bottom of the index. New Nifty 50 companies come from the Nifty Next 50 index; companies that lose their spot in the Nifty 50 index move down to Nifty Next 50. Likewise, for the Nifty 500 index, the companies that enter and leave tend to be small cap companies that take up a small allocation in the index.

Intuitively, we can hypothesise that the impact of the churn can be large in a large cap index that holds only 50 companies compared to an index that holds 500 companies. The churn as a percentage of the market cap is going to be relatively low for the Nifty 500 index while it can be relatively much higher for the Nifty 50 index.

What about tracking error?

Tracking error is a measure of how much an index fund deviates from the index it tracks. It shouldn’t be a surprise that Nifty 50 index funds will have a lower tracking error than Nifty 500 index funds. Why? Because buying and selling 500 companies at the right weights is a lot harder than buying and selling 50 companies at the right weights. The increased impact cost of smaller size companies in the Nifty 500 index will also cause the tracking error to go up.

But tracking error should come into consideration only when there are multiple index funds tracking the same index. In other words, we first pick an index to invest in, and then choose a fund that has the least tracking error historically.

I have seen advice that recommends against investing in large indices like Nifty 500 because they tend to have high tracking errors. In my view, your portfolio companies and diversification are more important than technicalities such as tracking error. There is no need to sacrifice diversification only to get a lower tracking error.

Conclusion

So, what is the better index to invest in? Nifty 50, or Nifty 500? As with most things in finance, there is no one correct answer. Those who care more about cost and liquidity but are okay with a high portfolio churn and less diversification can choose Nifty 50. Those who are okay to pay more in terms of impact cost but prefer a more passive, more diversified portfolio can choose Nifty 500.