I am a ‘cashback harvester’. I spend way more energy than I should in maximising the credit card cashback I earn. What follows is minutia around cashback policy of 2 credit cards. If such petty details are not your thing, you’ll be better off skipping this post. 🙂

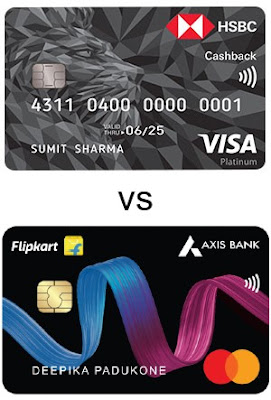

I hold multiple credit cards and I consciously choose the right card to use for every transaction. The ‘right’ card is the one that gives the maximum cashback, of course. Until a few weeks ago, HSBC Cashback card was my default card, primarily because that was the best among what I had (i.e. this is not an objective judgement or recommendation). Then I got Axis Flipkart card and started using the Axis card for everything because it gives me 1.5% cashback on all spends while the HSBC card only gives 1.5% cashback on online spends. But the first statement for my Axis Flipkart card reminded me of the old saying, ‘the devil is in the details’. Let’s look at how the HSBC Cashback card continues to be the better card in some areas.

- Any spend less than ₹100 will not earn any cashback on the Axis card. The HSBC card doesn’t say anything like it.

- Cashback on the Flipkart card is rounded down to the nearest whole rupee for each transaction. Doing this for each transaction means the aggregate cashback Axis gives is considerably lower than what one might expect looking at the statement total. For example, I spent ₹181 on the card and that has fetched me ₹2 cashback. One would expect to receive ₹181 × 1.5% = ₹2.715, but will have to forego ₹0.715 because of the rounding down.

- all online transactions because there’s no rounding down

- any transaction less than ₹100, be it online or offline

While the HSBC card continues to remain relevant for me, I must also highlight that Axis Bank’s credit card statement makes it very easy to see how much cashback is being earned for each transaction. HSBC doesn’t reveal as much information, so the customer will have to do the math themselves to see if they are getting cashback for every transaction that they think they are getting cashback for.