The core of my equity portfolio is Vanguard FTSE All-World ETF (VWRA). I wanted to invest in the FTSE Global All-Cap Index through VT, but I had to avoid VT because it is US domiciled. (Reason: The case against investing in US assets.)

While VWRA is a pretty good substitute, at times it felt to me like a compromise. I really wanted to hold as many companies as I can.

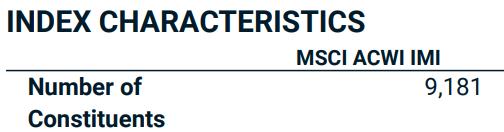

A few days ago, I came across the IMID ETF that invests in the MSCI ACWI IMI index. This index is comparable to the FTSE All-Cap index with 9000+ companies from across the world. The ETF is Ireland domiciled. It even charges less expense ratio than VWRA (0.17% vs 0.22%)!

It was a dream come true. Or so it seemed.

I happily announced my discovery to Sayan Sircar, but I was surprised by his lack of enthusiasm. He told me about the “sampling” strategy that some ETFs and index funds use. This helped me dig more and see why IMID was not as amazing as I had thought.

What is “sampling” in ETFs?

The FTSE All-World index has 4163 companies. VWRA, the ETF that tracks this index, holds only 3691 companies. The remaining companies are not “in the sample” that the ETF uses.

|

| VWRA’s portfolio as on 31 May 2023 |

My jaw dropped when I looked at the holdings of IMID. While the index has 9181 companies in it, the ETF is holding less than 2000 companies! I immediately understood why Sayan was not enthusiastic about this ETF.

|

| Constituents of the MSCI ACWI IMI index |

| Holdings of the IMID ETF |

I like index funds more because they are passive, and less because they track an index. (See: Not all index investing is passive investing.) An ETF that replicates an index’s performance while holding less than 25% of its constituents is anything but passive. I don’t want such a fund anywhere in my portfolio.

Takeaway

I have learnt this now: Not every index fund fully replicates its underlying index. When choosing an index fund, pay attention to how accurately the fund replicates the index. This is especially important if the index is large and diverse.

You have saved me thousands of pounds. I never thought about Ireland domicile etfs and their implications from the UK

ReplyDeleteYou are so welcome. I am glad this helped you!

Delete