Have you come across investment opportunities that quote very attractive XIRR numbers? Have you been tempted to invest in those just based on the XIRR? This blog post is for you—to discuss what XIRR means in a practical sense.

An example to understand XIRR

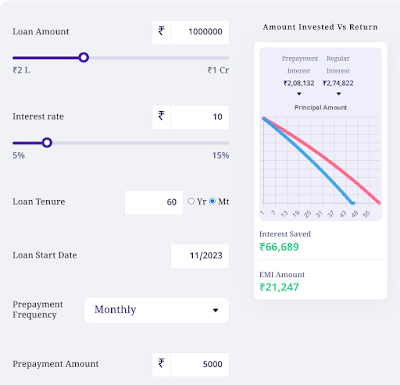

Let’s say I borrow ₹10,00,000 from my bank at 10% per year interest, which I promise to pay over the next 60 months. The bank will ask me to pay ₹21,247 every month. Assuming I pay exactly ₹21,247 every month from November 2023 through October 2028, I would have paid a total of ₹12,74,820. While quoted “interest rate” is 10.00%, the XIRR of this loan is 10.46%.

Let’s say I am able to pay this loan off more aggressively. If I pay ₹5,000 more every month—i.e. I pay ₹26,247 every month—how much will I save? Based on Fisdom’s calculator, I’ll be saving ₹66,689 in interest overall. The loan will be closed in 47 months instead of 60.

If I follow the original schedule, the bank receives repayments at the XIRR of 10.46%. Now that I am more aggressively repaying the debt, the total interest I pay goes down, but the XIRR increases to 11.31%!

What does this mean? A higher XIRR does not necessarily mean higher overall earnings.

How is this information practically useful?

Does this mean XIRR is a misleading metric that we should just ignore? Not really. XIRR takes into account the “time value” of money. A higher XIRR is useful to those who can optimally reinvest all the cash flow coming to them, as it is coming to them.

A higher XIRR is useful to a big bank since they can take this cash and lend to another borrower. A higher XIRR will mean the bank’s loan book can grow faster. However, if you, a retail investor, tend to simply accumulate the repayments in your savings bank account, the higher XIRR is often bad for you.

How to decide about high XIRR investments?

Some investment products show their high XIRR return prominently everywhere. If you calculate the CAGR return of the same investment, the rate may be low. But because the XIRR looks a lot more attractive, they promote the investment by quoting the XIRR number.

You can invest in such an investments if you have the ability to optimally reinvest all the repayments as they hit your bank account. If you cannot reinvest so quickly—most retail investors cannot—then you are better off ignoring the quoted XIRR and calculating the investment’s CAGR instead. Or, just calculate the corpus you’ll get from this investment and compare that with the other investment you may make instead (such as PPF or bank deposit or debt mutual fund).

No comments:

Post a Comment