I started goal-based investing in 2020; a little more than a year ago. I invest in Kuvera’s recommended portfolio with some tweaks. One of the tweaks is to invest in an Ultra Short Term debt fund rather than a Liquid fund as recommended by Kuvera. In this post, I am going to describe how I made that decision and review whether that was a sensible decision.

Why I chose Ultra Short Term debt funds?

Back in early 2020, I was looking at many debt fund options. I was a naïve newbie investor back then, so I didn’t pay much attention to anything beyond returns. I noticed that Liquid funds were giving around 6% return while Ultra Short Term funds were giving around 8% return. Other categories had a longer duration, but the returns were around 8 or 9% only. I was told that longer duration means higher risk. I didn’t know why the risk was higher, but I avoided investing in any duration longer than Ultra Short because there was no reward (higher return) justifying the higher risk.

Basically, I chose Ultra Short over Liquid because Ultra Short gave better return than Liquid. (This was dumb; you please don’t make this mistake!)

Dabbling with different debt fund categories

Though I had decided to invest in Ultra Short Term debt, my search for an “optimal” debt fund never stopped. I kept looking at many options, including Credit Risk, Short Duration, Medium Duration, Equity Arbitrage, and even Conservative Hybrid. I started getting convincing answers only after I learned to look at rolling return graphs to get a summary view of historical returns over many years. (Huge Thanks to RupeeVest.com for making rolling return data available for free!)

With rolling return graphs, I am able to see fund behaviour more clearly than the NAV graphs that everyone shows. Let’s compare the historic returns (1 year rolling returns) of an average liquid fund (Edelweiss Liquid Fund) with a high-performing medium duration fund (SBI Magnum Medium Duration Fund).

|

| 1 year rolling returns of SBI Medium Duration fund (green line) vs Edelweiss Liquid fund (purple line) |

Two things stand out immediately:

- The returns from the liquid fund is more predictable (less volatility)

- While the medium duration fund has given higher returns at times, it has also given less returns than the liquid funds.

If (i) you’d be holding your debt investments for a few years, and (ii) you don’t intend to redeem and reinvest based on interest rate movement, the returns you’d get from a liquid fund is going to be similar to what you would get from the medium duration fund. In other words, the higher risk or higher volatility may not really translate into higher returns!

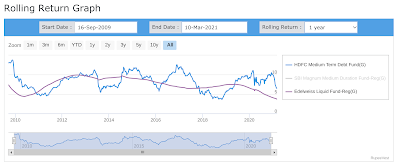

We observe the same pattern when comparing with another high performing medium duration fund. The HDFC medium duration fund has less volatility than the SBI one, but it’s still considerably more volatile than the liquid fund. The average returns are still not considerably better than the liquid fund.

|

| 1 year rolling returns of HDFC Medium Duration fund (blue line) vs Edelweiss Liquid fund (purple line) |

So, what’s the takeaway here?

Longer duration debt definitely gives you more volatility, but the returns may not really justify the added volatility.

But what about Ultra Short Term?

After seeing this data, I had to know if I have made a mistake by choosing Ultra Short Term fund instead of Liquid. So I added my favourite Ultra Short Term fund to the graph:

|

| 1 year rolling returns of HDFC Medium Duration fund (blue line) vs Edelweiss Liquid fund (purple line) vs L&T Ultra Short Term fund (teal line) |

|

| 1 year rolling returns of Edelweiss Liquid fund (purple line) vs L&T Ultra Short Term fund (teal line) |

We see the same pattern again. The return lines are interwoven and the average is likely the same for both lines. My decision to invest in ultra short term funds is not particularly bad, since the volatility isn’t that high. But I may not really be getting higher returns as I had hoped.

Are longer duration debt funds useless then?

Of course not. They are useful if you know how to use them. Longer duration debt funds give opportunities to investors who are willing to buy and sell tactically to benefit from interest rate movements. You can earn a good return if you can sell your longer duration funds when the interest rate goes down. You need to watch the market and actively buy and sell.

But if you’re like me, and just want to hold the funds until your goal date, longer duration debt increases the likelihood of capital loss without increasing your returns by much.

Superb article. Thanks for writing.

ReplyDeleteThank you! 😊

DeleteVery good post. Thanks for writing.

ReplyDelete