A few months ago, I made a blog post arguing that you should avoid volatility in debt investments. To summarise, these were my arguments:

- When your financial goal is reached, all your money will be in debt investments. If there’s volatility in your debt portfolio, you might end up losing money. (Assumption here is that you don’t have flexibility around when you need to spend this money.)

- It’s fine to invest in volatile debt investments as long as you’re willing to manage the volatility. For example, gradually moving money from your volatile debt investments into more stable debt investments. While doable, this is more work because you’re now rebalancing between 3 asset classes (equity, high volatility debt, and low volatility debt) instead of 2.

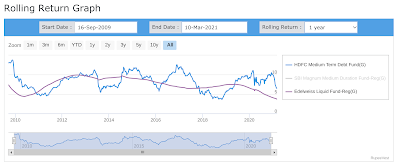

As a follow-up to the 2nd point, I made another blog post where I compared the performance of a volatile debt fund with a liquid fund. While you do earn a little bit more on average — say 8% instead of 7% — the volatility can cause a loss if you don’t effectively manage the risk. I recommended avoiding volatility because that’s a good tradeoff for many people. Simple is better than complex.

Recently I learned that there are some open-ended target maturity debt funds in the market. To make sense of these funds, we must first understand what “open-ended” and “target maturity” mean.

“Target maturity” debt funds invest in bonds that mature at a predetermined time. As an example, you can invest in a fund that matures in June 2026 if your financial goal is within a few months from June 2026. This fund will be volatile in the early years, but you will not be affected if you stay invested till maturity. The fund’s volatility will keep on reducing as we approach the maturity date because interest rate risk keeps reducing until it becomes nil on the maturity date. (Remember that credit risk does not reduce, so this isn’t entirely risk free.)

Fixed maturity funds have usually been closed-ended, meaning you can only invest in them during their NFO period; you can exit only at maturity. (You can buy/sell in the secondary market, but that’s not always practical.) Closed-ended funds are too inflexible to use for goal-based investing because rebalancing between debt and equity will be very hard. You want to be able to buy and sell your assets freely. In other words, you want open-ended schemes that allow you to buy and sell whenever you like.

Now that we know what “open-ended” and “target maturity” mean, let’s look at why open-ended fixed maturity debt funds are perfect for goal-based investing.

- Though the debt investment is volatile in the beginning, its volatility keeps reducing over time. This means that you don’t need to manage interest rate risk (which causes volatility), but the scheme automatically manages volatility. The only requirement is that you need to hold the investment till maturity.

- Because high duration debt usually provides a little bit more return on average, you also end up making a little bit more return than investing in a liquid fund throughout the investment period. The difference is likely not huge, but this is free money since you’re getting this additional return without increasing risk or complexity.

Right now, there are open-ended fixed maturity funds that mature in 2023, 2025, 2026, 2027, 2028, 2030, and 2031! It’s possible that AMCs will launch similar funds that mature in other years as well. You may just have to wait for some time before an AMC introduces a fund that matures at a time suitable for you.

Choose a fund that matures very close to your goal

- Do invest in a fund that matures no more than a few months before your goal date.

- Do not invest in a fund that matures much before your goal date. You’ll pay taxes on the maturity proceeds and park the money in a safe place (say a bank deposit or a liquid debt fund). This parked money will have short term capital gain that’s taxed at a higher rate.

- Do not invest in a fund that matures much after your goal. You will need to exit the investment before maturity. While open-ended schemes allow that, you’ll be exposed to volatility at the time of exit.