Much before I knew what investing was, I “invested in” an LIC policy. I had the desire to save for the future, but I had no idea what I should be doing. I consulted a friendly LIC agent, and he advised me to get this policy. I bought the policy with my eyes closed. More than a decade later I understood what this policy was like. This is a participating policy, so the investment return is not predetermined.

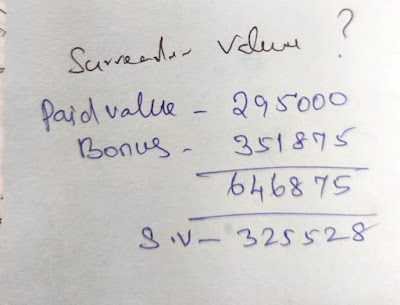

When I had paid premium for 15 years, I asked an LIC branch to tell me the surrender value of this policy. The policy’s total value came to be over ₹6.46 lakhs. However, if I were to surrender the policy (i.e. abandon the investment), I’ll get just a little bit more than the premium I had paid.

For the corpus value of ₹6,46,875, the growth rate (XIRR) is an impressive 9.52%. But if I couldn’t continue the investment for any reason, I’ll only get ₹3,25,528. Growth rate for that is a measly 0.81%! A return of 0.81% after paying on time every single premium for 15 years straight.

To my surprise, most people seem fine with this. They only look at the 9.5% return, but ignore the lack of liquidity. When discussing liquidity, I ask people this question: “If I have ₹10,00,000 in my PPF account that matures in 5 years, and I need ₹6,00,000 today for a surgery, do I really have that ₹10,00,000?” The answer is No. If you cannot spend the money, you effectively don’t have it.

That’s my main problem with all these insurance + investment products. They give you a good or great return as long as everything goes perfectly as planned. The moment you have to deviate a bit from the original plan, you end up with a big loss. Imagine earning an annualised return of 0.81% on a 15-year investment. That’s as good as gifting money to the insurance company!

If you are considering buying one of these insurance plans with the focus of investing, here is my advice:

- Don’t. Liquidity is just one problem. There are many other issues with these products: high cost, low return, insufficient insurance coverage, etc.

- If you must buy one, choose a plan that has a short time horizon. A 5-year investment plan is easier to adhere to than a 25-year investment plan. The longer the time duration is, the more you need liquidity and flexibility.