Every sane person I know agrees on this: you should not look for returns from your emergency corpus. “Keep the money in highly liquid forms, such as bank deposits or liquid debt funds; never buy volatile assets with that money,” they advise. I did not understand this advice. “What’s the harm in investing, say 10 to 25% of the corpus in equities?” I thought. The other 75 to 90% is not volatile, so you have access to cash when needed. The exposure to equities will keep your emergency corpus growing at a rapid rate (over a long duration such as 10 years).

This line of thinking led me to put most of my emergency corpus in a hybrid mutual fund. My new financial advisor said that this was a bad idea and asked me to move that money over to liquid funds and bank deposits. “Don’t look for returns from this money,” he said.

Since then, I have been thinking about this. It’s hard for me to do something because “the advisor says so.” I needed a convincing reason for why volatility is a strict no-no. After some thinking, I have come up with an analogy for explaining this.

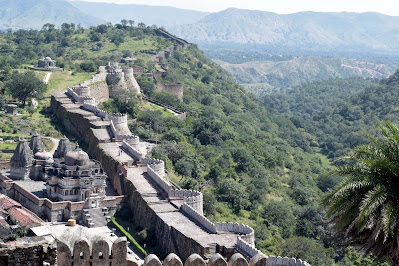

If your wealth is kept inside a fort, the emergency fund is the wall of that fort and the moat around the wall. Anyone who has been to a fort will know: the walls of a fort are so wide that you can drive cars on them.

|

| External wall of a fortress. Image credit: Dr D S Sinha, licensed under CC0 |

Imagine you are a king. Your fort also has such strong walls as protection. Maybe you have a moat around the walls too. These walls take up so much space! In all likelihood they also cost significant amount of money to keep in good repair. Now you think about it and say, “The walls and the moat take up a lot of space. What a waste of useful land! Wouldn’t it be better if we used this space for farming or housing?” How would your ministers and advisors respond?

This is exactly the reason for keeping the emergency fund liquid and without volatility. When there is an unforeseen need, you’d burn through your emergency corpus before you start to liquidate your long term assets. The wider the moat and the walls are, the safer your long term assets are. The wider the moat and walls are, the more farming land you give up for the sake of protection.

With this picture in mind, I don’t feel too bad keeping all of my emergency corpus in low-yield nonvolatile assets.